Is Luke Lango really the “#1 Stock Picker” that they’re telling us he is? Or is this guy just a scammer trying to sell you an overpriced subscription to his mediocre investment newsletter services?

I’ve been reviewing investment newsletter services for the better part of 5 years now and Luke Lango is someone who’s become more popular lately.

But, from what I’ve seen, this certainly doesn’t mean his stock picks are actually good.

To see if he’s a legit and trustworthy guy, I ended up joining one of his most popular investment newsletter services, which I’ll go over in a bit (you’ll want to read what I found out).

But first, let’s go over who this guy is in the first place.

Who the heck is Luke Lango?

My guess is that you’ve probably come across one of his investment teasers. You know, one like this where he teases a new hot investment opportunity to get filthy stinkin’ rich..

He works for the company called InvestorPlace, which is a “wholly owned subsidiary of MarketWise” – a company that owns a lot of the smaller companies out there providing investment newsletter services, such as Stansberry Research and Chaikin Analytics for example.

According to his LinkedIn profile, Lango has been working for InvestorPlace since 2017. First he worked as an “Investment Analyst” and now has the title of “Chief Technology Strategist”, which is a title he got in 2021.

I’m guessing that when he started back in 2017 as an investment analyst he was more of a behind-the-scenes guy helping identify promising investments. But now, as we all know, his face is plastered everywhere (good looking guy, right?) and he has a handful of his own investment newsletter service.

But it wasn’t like he just got started in the investing world in 2017. Before joining InvestorPlace, he worked as an investment analyst for a firm called Feinberg Investments and was also actively providing investment analysis on Seeking Alpha since 2013.

So, while he doesn’t have any billion-dollar hedge fund management experience under his belt, he has been actively involved as an investment analyst for over a decade.

Investment Focus

Even if you had just heard of Luke Lango for the first time recently, you’d already know that he’s all about the future.

He likes to invest in innovative technology. That’s what gets him going.

Some of his more popular newsletter services include:

- Innovation Investor, where he looks for innovative “hyperscalable” companies to invest in (think tech companies).

- Ultimate Crypto, where he looks for cryptocurrencies that have real-world utility.

- Early Stage Investor, where he looks for the same types of companies as with his Innovation Investor service, just there’s more of a focus on getting in as early as possible.

It’s all about chasing trends and the hottest new stocks/cryptos.

And this is great and all. All you need to do is get it right one time with a big winner and you could be set up for life. But this type of investment focus does often lead to a lot of losers, as you’ll see when I go over the performance of his one service in detail.

Recommended: Go here to see my #1 recommended stock advisory service

I joined his Innovation Investor service to see how good he really is..

Yep. I actually joined this $500/yr service, which is probably his most popular one.

He got me. He lured me in like a fish with all those claims of striking it rich.

So, let’s get to it.

Spoiler: It’s not my cup of tea, but not too bad either.

- Editor: Luke Lango

- Publisher: InvestorPlace

- Investment Focus: Innovative “hyperscalable” companies

- Cost: $499/yr

Innovation Investor’s goal is to identify innovative companies with “hyperscalable’” businesses in unstoppable megatrends.

“Unstoppable megatrends”?

“Hyperscalable”..?

Sounds cool.

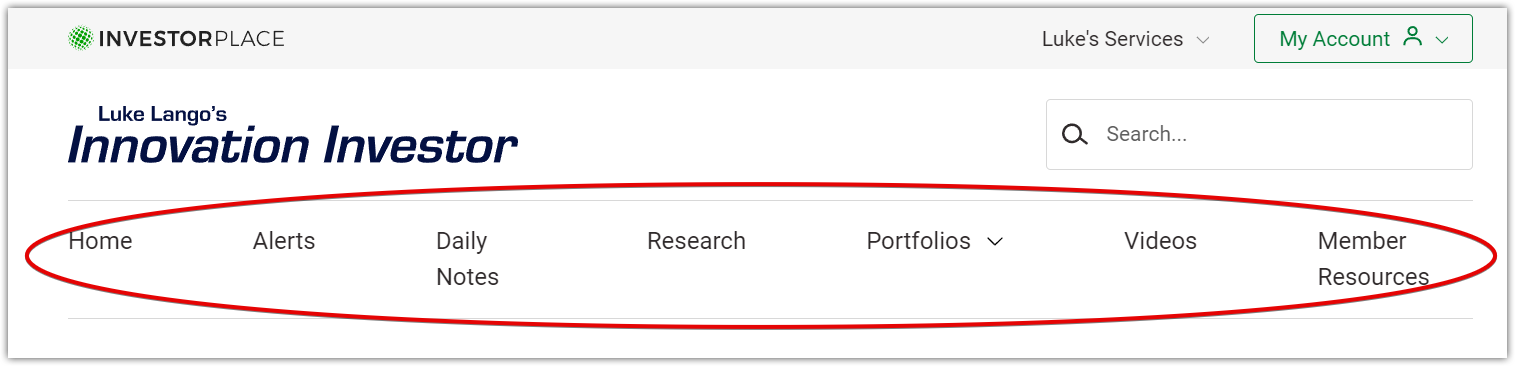

And I will admit that the layout of this service once I logged into my account was satisfying.

The member’s area is nicely laid out and I can’t complain much here, which is expected considering InvestorPlace is the publisher here and has years of experience with newsletter services such as this.

Here, you can easily navigate around to see buy/sell alerts, research reports where he goes over the latest investment opportunities he’s targeting, the portfolio of all his recommendations, etc.

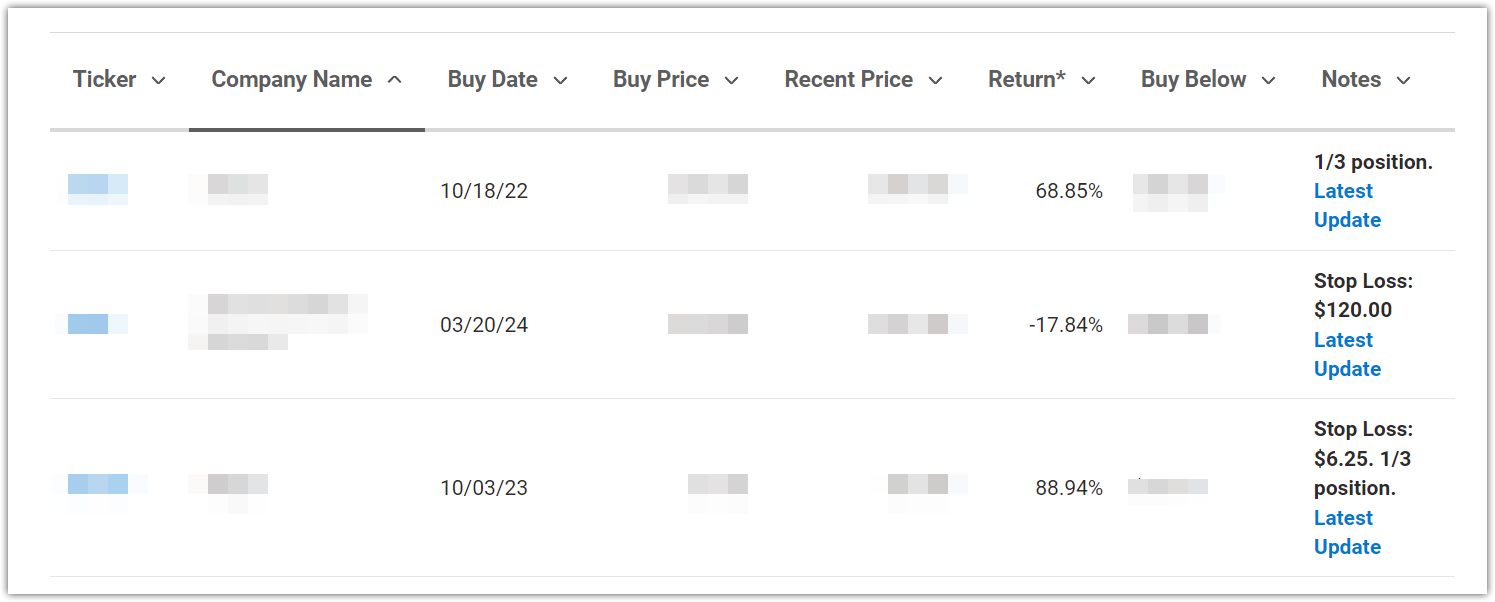

The portfolio also has a nice layout and is easy to understand (important), with the ticker, name, buy date, buy price, return, and so on are all neatly available for each stock (or crypto) pick..

At the moment, there are 83 picks in his Core portfolio and 10 picks in the Venture one.

That’s quite a bit – 93 total.

But who really cares about all of this.

The main thing we want to see is how well his picks perform. A nice website is great, but if he’s not making us money then what’s the point?

Lango’s Track Record

If you were to whip out $499 and join this service for a year, how good would his recommendations be?

Let’s take a look.

In this Innovation Investor service he has his portfolio broken down into 2.

- Core Portfolio

- Venture Portfolio

Let’s take a look at those Core portfolio recommendations and how they’ve fared up until now first.

Core Portfolio Performance:

This portfolio is focused on mid-risk, mid-reward investments. It consists of (at the moment) 81 stocks and 2 crypto picks (83 total).

If we do the math to figure out the average return for Lango’s recommendations here we come up with a whopping 531.41%!

Now… that’s a lot… but don’t get too excited just yet.

If we add up the percent return of all 83 picks we get 44,107.20%.

Divide that by the 83 picks and we get that 531.41% average.

HOWEVER, this number is greatly inflated due to some big outliers – goldmine picks that really skyrocketed.

His top 2 picks here brought in:

- 35,384.66%

- 2,356.41%

And that top pick there is a cryptocurrency (2 out of the 83 picks are cryptos).

Of course, I can’t tell you what these 2 picks are, but I can say that there’s no doubt you and your grandmother have heard of both of them by now.

Anyways, the point is that these two have performed incredibly well, but don’t represent the norm.

If we remove the top 2 picks and do the math again, we get an average return of 78.59%.

44,107.20% minus 35,384.66% (top performer) minus 2,356.41% (second best) = 6,366.13%

Take that number and divide it by 81 picks (83 minus 2) and you get 78.59%.

Quite the difference here.

And if we were to remove the 3rd best performer we end up with a 70.04% average.

So, let’s be honest here. A 70% return on average is pretty decent, especially considering the average holding time so far is just over 1.5 years (not exact!).

Nothing spectacular, but still pretty darn good.

Now, that overall 531.41% return overall. That is spectacular.

But we’re not done yet. We still have to take a look at the Venture portfolio.

Venture Portfolio Performance:

This one is focused on high-risk investments but also high-rewards.

It consists of 10 stocks.

Crunching the numbers we get:

91.85% (averages added together) / 10 stock picks = 9.19% average return… seems like the ‘high-risk’ part of this portfolio is better reflected in the current average return.

Now that’s just plain disappointing – a ~2-year average holding time here.

OVERALL PERFORMANCE:

What does the overall performance look like if we take all of Lango’s picks from both portfolios here at Innovation Investor?

If we take the overall average we come up with a 475.26% average.

If we remove those top 2 performers from the list again then that average falls off a cliff and drops down to 69.44%.

Take these numbers as you want.

While the overall performance is great, you can’t really expect these types of returns. Out of the 93 picks total it’s mainly 2 top picks that prop that percentage up.

Recommended: Go here to see my #1 recommended stock advisory service

Red-flag alert

ALSO, before you fork over $499 to Investorplace for this service (or any other Lango service), you should know that they DO NOT OFFER MONEY-BACK REFUNDS.

I read a few other reviews for this service out there stating that they offer a 60-day money-back guarantee, but from what I’m seeing right now this is no longer true.

From the website…

So there you have it… you have 30 days to decide if you like it or not. If you don’t, you can ONLY get a credit, NOT your money back.

What this means is that Investorplace will give you a $499 credit to use towards any other of their services. That’s it.

This is a big red flag for me.

I really don’t like this kind of policy.

It’s really no more difficult for them to just refund an unhappy customer their darn money back, but they won’t do that.

Besides this red flag, let’s not forget the hyped-up teasers that they use to lure in new subscribers.

Conclusion – Scam or legit?

Luke Lango definitely isn’t a scammer. He is a legit investment analyst with over a decade in the space and he has picked some astronomical winners over the years from what I’ve seen.

However, take what he says with a grain of salt and remember that those big winners are very far and very few between.

If investing in ‘hot’ tech stocks is something that excites you then maybe you should consider joining his services, but for me this isn’t my cup of tea.

I don’t like the overly-hyped-up investment teasers and definitely don’t like the look of that refund policy.

If this isn’t your cup of tea either then I highly suggest taking a look at my #1 recommended stock-picking service.

My #1 recommended stock-picking service

The funny thing is, this is pretty much the complete opposite of Lango’s Innovation Investor and his other services.

Instead of looking for the next hottest tech stock, Insider Newsletter (the name of my recommendation) looks for out-of-favor, boring stocks that have usually been undervalued for years, yet are still vital for the functioning of society.

This way, they mitigate risk while still looking for big rewards.

Generally speaking, they look for 3X+ returns on their stock picks, but even a 20Xer isn’t something unheard of.

So, while these stocks might not be the sexiest. There’s nothing unsexy about a pick going up 3X+.

Not only that, but the guys running Insider Newsletter also don’t hype the heck out of their service. They spend their time and money actually providing the best service possible, not marketing it to no end.

My recommendation: check out Insider Newsletter before you think about joining Lango’s Innovation Investor.

As always, I hope this review has provided you with some real value. Let me know what you think about all of this below 🙂