When it comes to the world of investment newsletter/advisory services, there are lots of scammy/misleading practices employed.

I’ve reviewed hundreds of these services over the years and I’d like to bring a few common red flags to your attention so that you can better navigate this world so full of marketing hoopla and make better decisions before getting sucked into any of these services.

Let’s begin.

Red Flag #1: Sensational Teasers

I’m sure you’ve come across some already. You know… those investment presentations that tease the next best investment opportunity… often for ‘free’… but really you have to buy into their investment newsletter service before you can get your hands on the teased pick.

For example, this:

If I added up all the time I spent watching these sensationalist teasers over the years it would probably sum up to a few weeks easily.

Now, I don’t think that these sorts of teasers are bad in and of themselves. It all depends.

What I’ve found is that these teasers often rely on misleading potential customers to sign up… usually with absurd claims of making boatloads of money in the most blue-sky scenario possible.

While I wouldn’t say that you should avoid an investment newsletter service just because they try to lure in new subscribers with this kind of promotion, I would advise that you be wary of them.

*My #1 recommended stock advisory doesn't use hyped-up marketing teasers.

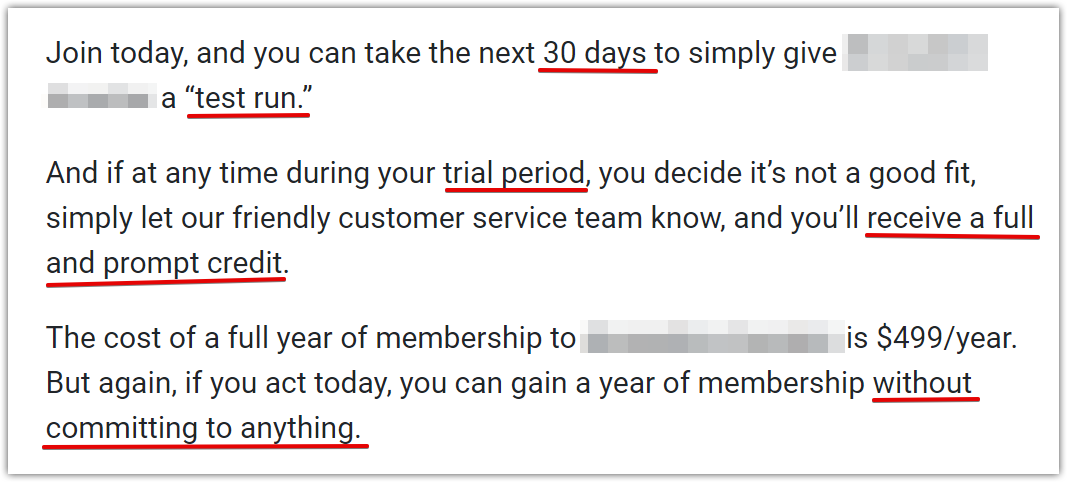

Red Flag #2: Refund Credits

Please. Always read the refund policy of these services BEFORE joining.

The best-case scenario is that they offer a money-back guarantee and allow you to test out the service for a month or so.

But, this isn’t always the case and it’s become quite common to see places offering only credit refunds.

For example, for this service they state that you have “30 days” to give it a “test run” and that during this “trial period” you can cancel at any time to “receive a full and prompt credit”. So… supposedly you can sign up “without committing to anything”..

But if you sign up you CAN NOT get your money back!

How is this not a commitment?

This type of trickery is a major red flag to look out for. Always look for that “money-back” guarantee.

*My #1 recommended stock advisory also offers a real money-back guarantee.

Red Flag #3: Unclear Track Record

How well does the investment newsletter perform?

If there is no track record given… well… maybe it doesn’t perform very well. Or maybe it does..? The point is we don’t know.

And what I’m talking about here is an overall track record of the performance of the service’s recommendations, not some cherry-picked winners which is what we often see in those teaser presentations.

This said, I’d say that well under 50% of the investment advisories I’ve looked into present any clear track record before joining. So, while this is a red flag, don’t let it keep you from subscribing to a service.

*Yep, the stock advisory I recommend also shows its track record clearly.

Red Flag #4: Renewed Pricing

If you’re joining for $99 for a year, please make sure that the service will renew at the same price. If not, you might be in for a rude awakening when it renews for $199 the second year.

This is a pretty common practice in the industry. They’ll get you in through a promotion and the renewal price is often overlooked – often in some small text below the payment form.

Red Flag #5: Hidden Subscriptions

This is easily one of the shadiest practices that I’ve seen when it comes to these types of investment newsletter subscriptions.

What happens is that, in very rare occasions, you’ll go to subscribe to one of these services and there will be a small notice below the payment form where it states that you’ll also be subscribed to some other investment newsletter service. Now, this additional service that you probably don’t even want will be free so that you’re only paying for the service that you actually want today, but when it comes time for renewal you will be in for a very unpleasant surprise.

This is very rare, so don’t worry about it too much. But I have seen it.

Some words of warning: always read that small print below the order form.

Red Flag #6: Massive Discounts

It’s extremely common to see pricing discounts for these services, which is fine, but just be cautious when these discounts are extreme.

For example, I recently came across an investment newsletter service running a 97.5% discount..

You have to ask yourself in these situations… why a they letting me subscribe at a 97.5% discount?

Nothing is free in this industry and so if they’re letting you join at a massive discount, be wary.

*The stock advisory I recommend offers a $1 trial for the first month. Of course, this is a massive discount, but it's clearly stated that this is only for the first month.

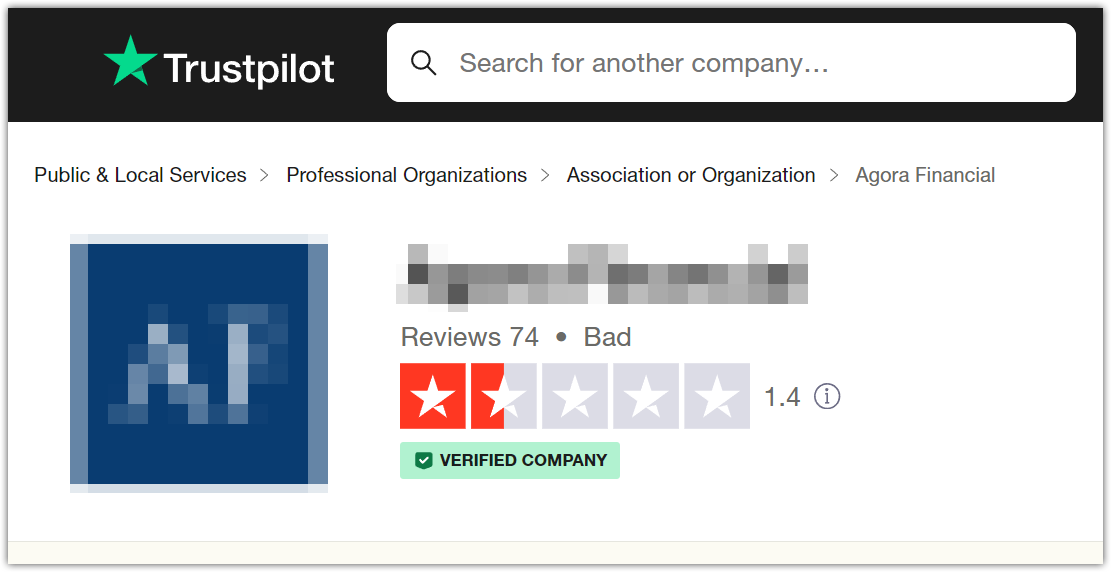

Red Flag #7: Low Customer Ratings

If I were you, I’d always jump on Google or Bing and look for some reviews. And not just long-form reviews like you’ll find on my website here, but at review sites where you can clearly see an average rating from everyone who’s reviewed the service.

TrustPilot is one of the better websites for this.

Here, you can clearly see the overall rating as well as read the individual reviews.

This is a ‘bad’ rating from a certain publisher in the investment newsletter space.

*Sidenote: Many of these companies receive worse reviews than they should because of how hyped-up and misleading their teasers are. What happens is someone joins thinking that they’re going to 100x their money on some investment and then they’re upset when this doesn’t happen.

The reviews don’t always accurately reflect how well a service performs, but they are always worth taking a look at.

*The stock advisory I recommend has a 4.9 out of 5 star rating the last I looked. And that's with around 400 reviews - nearly unheard of in this industry.

The Takeaway Here

The bottom line here is that the investment newsletter service industry is filled with misleading and scammy services. But this should steer you away from investing and from subscribing to any.

Just be cautious, that’s all.

I know I’ve mentioned the investment newsletter service that I recommend quite a bit through this post, maybe too much, but the fact is that it’s a darn good quality service that doesn’t show any of these red flags, and it’s quite unique in the way it targets 3x+ returns by investing in ‘toxic waste’ stocks (not literally of course).